By Digitvant MFB

Published: 12/15/2025

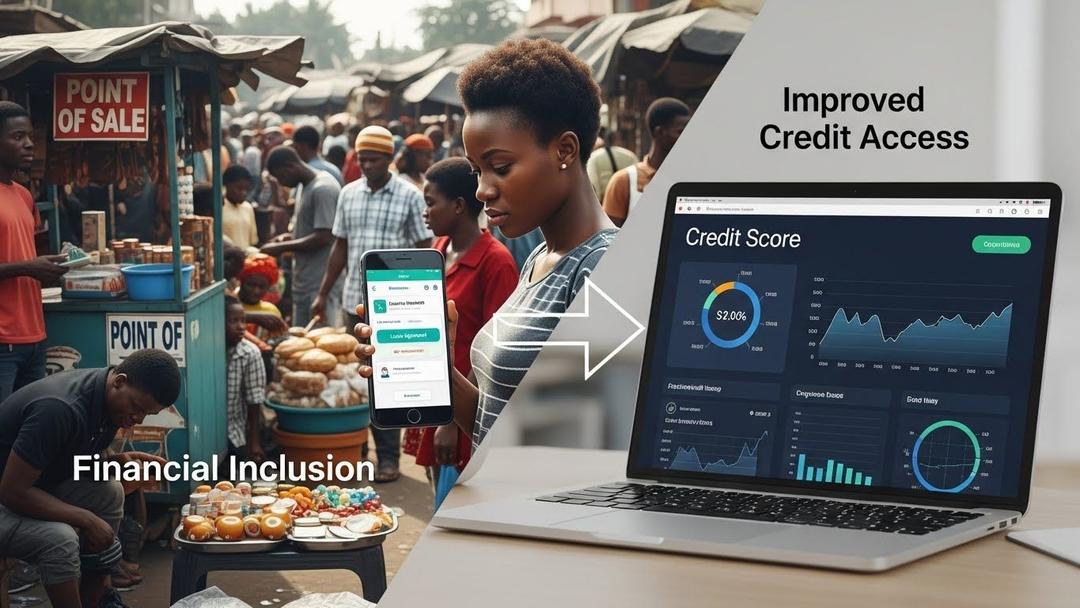

How Financial Inclusion Encourages Stronger Saving Habits in Nigeria

Financial inclusion in Nigeria is reshaping how individuals and families think about saving money. For many Nigerians, saving has traditionally been informal, inconsistent, and risky. Cash kept at home can be lost, stolen, or spent impulsively, while informal savings groups often lack security and flexibility. Today, financial inclusion is changing this behavior by providing structured, secure, and accessible ways to save. Through digital tools offered by platforms like DigitVant, Nigerians are developing healthier saving habits that promote stability, confidence, and long-term financial growth.

Why Saving Is Central to Financial Inclusion

Saving is one of the most important foundations of financial inclusion. Without the ability to save securely, individuals remain vulnerable to emergencies and unexpected expenses. Financial inclusion provides people with safe digital environments where money can be stored, tracked, and grown over time. When individuals trust financial systems, they are more likely to save consistently and plan ahead. With access to secure digital wallet and reliable digital banking services, Nigerians can separate daily spending from long-term savings. This structure helps households manage income better, avoid unnecessary borrowing, and build financial resilience.

How DigitVant Makes Saving Simple and Secure

DigitVant plays a key role in encouraging positive saving behavior by removing the complexity traditionally associated with formal banking. Through its intuitive digital platforms, users can save small amounts regularly without pressure or rigid requirements. Money saved digitally remains protected, visible, and easily accessible when needed. For individuals and small business owners, DigitVant’s inclusive banking approach ensures that savings tools are available regardless of income level or location. Entrepreneurs can save profits securely while also exploring growth opportunities through MSME microfinance. When emergencies arise, access to transparent low interest loans prevents people from draining their savings completely or resorting to unsafe borrowing.

Digital Savings and Household Stability

As financial inclusion spreads, more Nigerian households are adopting digital savings habits that support long-term stability. Parents can save toward school fees, healthcare, or housing improvements. Young professionals can build emergency funds and plan for future investments. Farmers and traders can set aside income during peak seasons to support lean periods. DigitVant strengthens this cycle by promoting responsible financial behavior through its sustainable banking framework. This ensures that savings are not only secure but also aligned with ethical and long-term economic goals. Users who want to understand DigitVant’s mission and values can explore the About page or seek assistance via the contact page. Existing users can manage their savings anytime through the iBank login portal.

Saving Habits and the Future of Financial Inclusion

The future of financial inclusion in Nigeria depends on building strong saving cultures across communities. As more people save digitally, financial systems become more stable, credit access improves, and households gain greater control over their economic futures. Saving transforms financial inclusion from short-term access into long-term empowerment. By offering simple, transparent, and accessible digital tools, DigitVant continues to support Nigerians in building saving habits that strengthen families, businesses, and communities nationwide.

Start Building Better Saving Habits Today

Take control of your financial future by saving smarter. Download DigitVant on the Google Play Store or Apple App Store and experience financial inclusion designed to help you grow.