By Digitvant MFB

Published: 12/15/2025

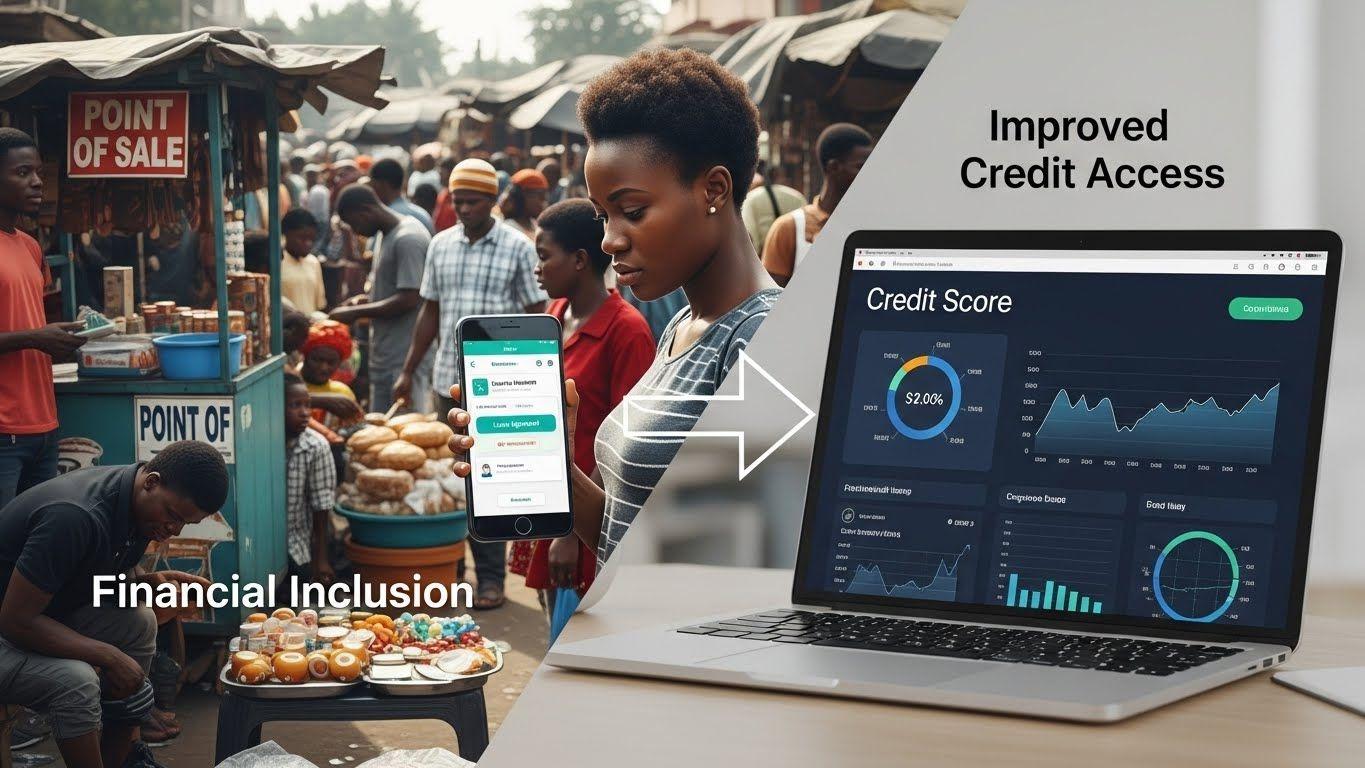

How Financial Inclusion Improves Access to Credit in Nigeria

Financial inclusion in Nigeria is reshaping how individuals and businesses access credit. For decades, many Nigerians were excluded from formal lending systems because of strict requirements, lack of collateral, and limited banking infrastructure. This left households and small businesses dependent on informal lenders with high interest rates and unpredictable terms. Today, financial inclusion is changing that reality by creating structured, transparent, and affordable pathways to credit through digital financial platforms like Digitvant.

The Credit Gap Created by Financial Exclusion

When people are excluded from formal financial systems, access to credit becomes extremely limited. Without transaction history, savings records, or digital identities, many Nigerians were unable to qualify for loans. This exclusion slowed business growth, restricted household planning, and increased vulnerability to economic shocks. Financial inclusion addresses this gap by introducing digital tools that help users build financial profiles and access responsible lending options. Through secure digital wallets and reliable digital banking, Nigerians can now create transaction histories that make them visible within the financial ecosystem. These digital footprints allow lenders to assess risk more accurately and offer credit solutions that match real needs rather than rigid assumptions.

How Digitvant Expands Credit Access

Digitvant plays a central role in expanding access to credit by offering transparent and affordable loan options designed for everyday Nigerians. Through its low interest loans, individuals can borrow responsibly to meet urgent needs, invest in education, or support small business growth. These loans are structured clearly so users understand repayment terms and interest charges before committing. For entrepreneurs and small business owners, Digitvant’s MSME microfinance solutions provide structured funding that supports expansion without the pressure of unrealistic collateral requirements. By offering microfinance through digital channels, Digitvant enables businesses to grow steadily while building credibility within the financial system.

Digital Credit and Household Stability

Access to credit is not just about borrowing money. It is about creating stability. With financial inclusion, households can respond to emergencies, smooth income fluctuations, and plan for future expenses. Digital credit allows families to avoid selling assets or resorting to unsafe borrowing methods during difficult times. Digitvant supports this stability by integrating credit access with inclusive banking systems that make financial management simple and transparent. As households learn to balance savings and credit responsibly, financial inclusion becomes a tool for long-term security rather than short-term relief.

Responsible Lending and Sustainable Growth

Financial inclusion must promote responsible borrowing to avoid debt traps. Digitvant supports this through its commitment to sustainable banking, ensuring that credit access aligns with ethical standards and long-term economic health. By combining digital access with financial education and transparency, Digitvant encourages users to borrow wisely and repay confidently. Users interested in learning more about Digitvant’s mission can explore the About page, reach out for assistance through the contact page, or manage their accounts securely via the iBank login portal. These touchpoints reinforce trust and empower users to take control of their financial journeys.

The Future of Credit Through Financial Inclusion

As digital finance continues to expand across Nigeria, access to credit will become more inclusive, data-driven, and fair. Financial inclusion will allow more Nigerians to qualify for loans based on behavior rather than background. With platforms like Digitvant leading this evolution, credit will no longer be a privilege but a practical tool for growth, stability, and opportunity.

Start Accessing Credit the Smart Way

Experience fair and transparent access to credit today. Download Digitvant on the Google Play Store or Apple App Store and begin your journey toward inclusive financial empowerment.