By Digitvant MFB

Published: 12/20/2025

How Financial Inclusion Improves Access to Housing and Shelter in Nigeria

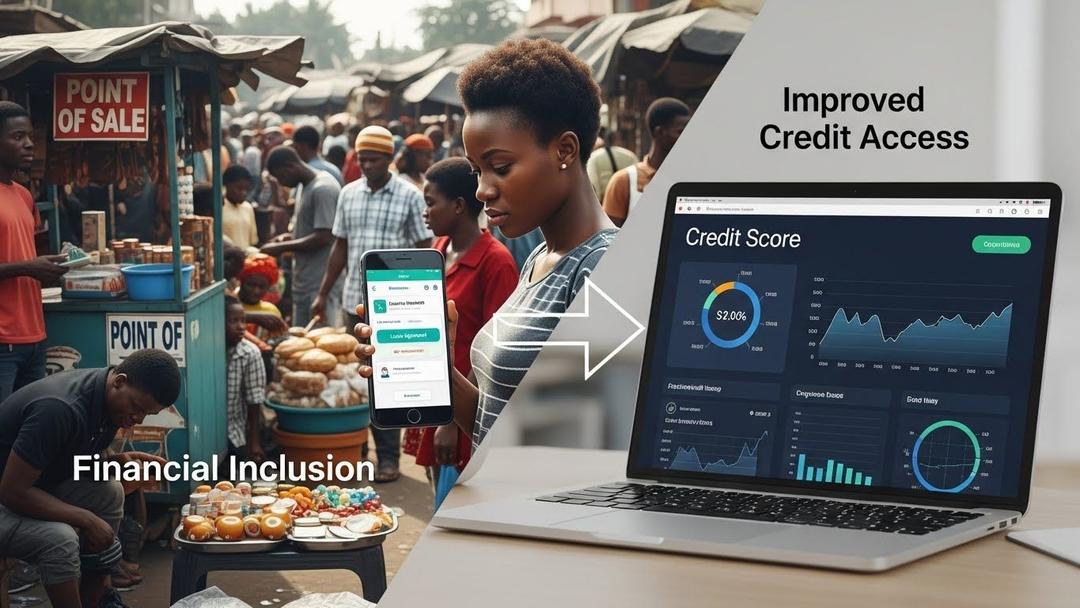

Financial inclusion in Nigeria is increasingly shaping how individuals and families access safe and stable housing. For many Nigerians, the challenge of securing decent shelter is not only about availability but also about finance. Irregular income, lack of savings structures, and limited access to credit have made it difficult for households to rent, build, or improve their homes. Financial inclusion is changing this reality by providing digital financial tools that help people plan, save, and access funds responsibly. Through platforms like Digitvant, financial inclusion is becoming a practical pathway to better housing outcomes.

Housing Challenges Linked to Financial Exclusion

Financial exclusion has long affected housing stability in Nigeria. Many households depend on daily or seasonal income, making it difficult to plan for rent, building materials, or home improvements. Without access to formal savings or credit, families often rely on informal arrangements that are unreliable and risky. These conditions increase housing insecurity and make long-term planning nearly impossible. Financial inclusion addresses this challenge by giving households access to secure digital wallets and dependable digital banking services. With these tools, individuals can save gradually for rent, home repairs, or land purchases while keeping their funds protected and traceable. This structure brings predictability and confidence into housing-related financial decisions.

How Digitvant Supports Housing-Related Financial Planning

Digitvant supports better housing outcomes by helping users organize and manage their finances effectively. Through its digital platforms, users can separate housing savings from daily expenses, making it easier to stay committed to long-term goals. Digital access also allows families to receive income and remittances instantly, ensuring timely rent payments and reducing the stress associated with cash shortages. When additional funds are needed, Digitvant’s low interest loans provide households with responsible short-term credit to address urgent housing needs such as repairs or relocation. For artisans, landlords, and small contractors, Digitvant’s MSME microfinance solutions help stabilize income and support housing-related businesses that serve local communities.

Digital Payments and Safer Housing Transactions

Digital payments have simplified how housing-related transactions are handled in Nigeria. Rent payments, service charges, and utility-related expenses can now be paid digitally, reducing disputes and improving record keeping. Families no longer need to carry large sums of cash or worry about delayed confirmations. Digitvant’s inclusive banking approach ensures that people across income levels and locations can participate in these digital housing transactions. By offering transparent and accessible financial tools, Digitvant helps households maintain housing stability and build trust with landlords and service providers.

Housing Stability and Long-Term Wellbeing

Stable housing is closely tied to long-term wellbeing and economic security. When families can plan for housing costs and respond to emergencies, they experience less stress and greater stability. Financial inclusion strengthens this process by enabling households to manage resources more effectively and avoid sudden displacement. Digitvant reinforces this stability through its commitment to sustainable banking, which promotes responsible financial behavior and long-term planning. Users interested in learning more about Digitvant’s mission can explore the About page, reach out for assistance through the contact page, or manage their accounts securely via the iBank login portal.

Building Better Homes Through Financial Inclusion

As financial inclusion expands across Nigeria, more households will gain the tools they need to secure safe and stable shelter. Digital finance allows families to move from survival-based decisions to planned investments in housing and living conditions. With accessible tools and transparent systems, Digitvant continues to support Nigerians in building better homes and stronger futures.

Plan Your Housing Future With Digitvant

Take the first step toward housing stability today. Download Digitvant on the Google Play Store or on the Apple App Store and experience financial inclusion designed to support secure and sustainable living.